Shifting Tides and a New Age of Exploration

Reflections on the clash of momentum vs fundamentals, why both are right - and how a unique setup involving macro, infra, and AI is underpinning crypto’s long awaited mainnet moment

The best part of ETHDenver 2024 was watching two opposing groups collide in a classic left-curve / right-curve debate.

One arrived with a risk-on, full send mentality in anticipation of a coming mega cycle.

The other came in struggling to find the fundamentals to make sense of today’s market euphoria.

In the short term, I think both are probably right. The setup for a massive, prolonged run up in crypto looks pretty good, even if the current momentum in public and private markets has almost certainly lost sight of fundamentals.

But a closer look suggests something different might be going on this time.

Where previous bull markets drove users, those cycles tended to look less like true adoption and more like a levered macro beta.

Today, those fluctuating waves of liquidity are set to give way to a permanent shift in the tides thanks to three major tailwinds:

Macro x Crypto’s Mainnet

The explosion in public and private markets—thanks to a mix of AI hype and economic optimism—masks several secular changes playing out.

In fact, rather than reverting to pre-pandemic norms, a very different geopolitical paradigm is emerging: one centered on fragmentation and cross-border competition.

While these new dynamics will materially challenge incumbents, they present a generational opportunity for crypto to make the jump to global adoption.

Crypto’s first decade was an extraordinary testnet marked by grassroots development, exuberant highs and difficult lows. Now in its second decade, crypto is ready for mainnet as the world’s interoperability layer: a neutral home for economic exchange and technological innovation in an age that desperately needs it.

Why?

For crypto, secular changes are positive tailwinds arriving at the perfect time.

Real structural shifts in the pipes that have underpinned global trade for the last two decades are being accelerated by very serious fractures in international relations. A restructuring of global supply chains and trade rails accelerated in 2023 and has become a core focus for companies and governments alike.

Meanwhile, over 54% of the world’s population and close to 60% of global GDP are undergoing an election cycle where protectionism is already a major focus as several major military conflicts play out in real time.

Equally relevant to crypto is an evolution in the art of international competition. Countries no longer rely solely on rockets and bullets.

America weaponized international finance in response to Russia’s invasion of Ukraine, while OPEC and Russia have shown they are happy to respond in kind by manipulating energy supplies.

In parallel, techno-nationalism around semi-conductors and other critical inputs has seen rhetoric replaced with action in the form of sanctions and subsidies.

This fragmentation of global commerce is damaging to margins in the developed world, while for the 40% of the world living in Lower-Middle Income (LMI) countries, the impacts are even more existential.

For individuals in LMI countries in particular, crypto provides vital solutions to everyday problems, and its importance only grows alongside systemic challenges. The data confirms this story: grassroots crypto adoption is not only reinforced but accelerated when geopolitical strains rise.

Likewise, for private enterprises this confluence of factors introduces significantly greater costs and restricts access to new consumer markets, all of this in a world where the cost of capital is no longer zero.

The trade wars & tariffs of the last few years have already proven damaging to businesses and domestic economies, and those negative impacts risk compounding as companies adapt to a new reality.

As a result, enterprises and individuals increasingly need to make a choice:

This crossroads reminds me of an intriguing historical parallel:

When Constantinople fell to the Ottomans in the 1400s, its new conquerors inherited control over a geographic nexus connecting global commerce across the ‘Silk Road’.

Famously, the Ottomans would soon move to restrict the overland trade routes that had thrived for centuries. The result pushed European powers to take to the seas in search of new trade routes, thereby igniting the ‘Age of Exploration’ that shaped the modern world.

This time around, it will be blockchains where the riches and perils of the New World will be found by those brave enough to set sail.

Reaching Enterprise Scale

There’s another important point worth hitting on: crypto has historically been a staging ground for large companies looking to experiment with a new technology.

Because of the factors covered here, the traditional enterprise’s exploration of crypto is now transitioning from R&D to production grade.

Companies will accelerate efforts to explore digital assets and onchain ecosystems as a key source of greenfield markets. What was once a vanity project will increasingly become an existential mission.

Capital allocators will scale up crypto-native deployment and participation to insulate against ‘beta’ exposure to global risk and uncertainty. There won’t be many places to hide in the old world.

Systemic challenges in different regions (inflation, capital controls, cold / hot conflicts) will drive even greater relevance and need for digital assets. Permissionless blockchain infrastructure will start grassroots before going global.

To be sure, economic and geopolitical challenges have always driven users to crypto, particularly in developing markets.

But the scale and scope of challenges the world must navigate in the coming years presents a unique window for crypto to become the de facto system for free commerce and culture.

Institutional Flows

Of course, all of this is contingent on the final piece of the puzzle: bringing institutional capital onchain.

The approval of spot BTC ETFs marked a major turning point on this front, and it would seem a similar outcome is on the horizon for ETH.

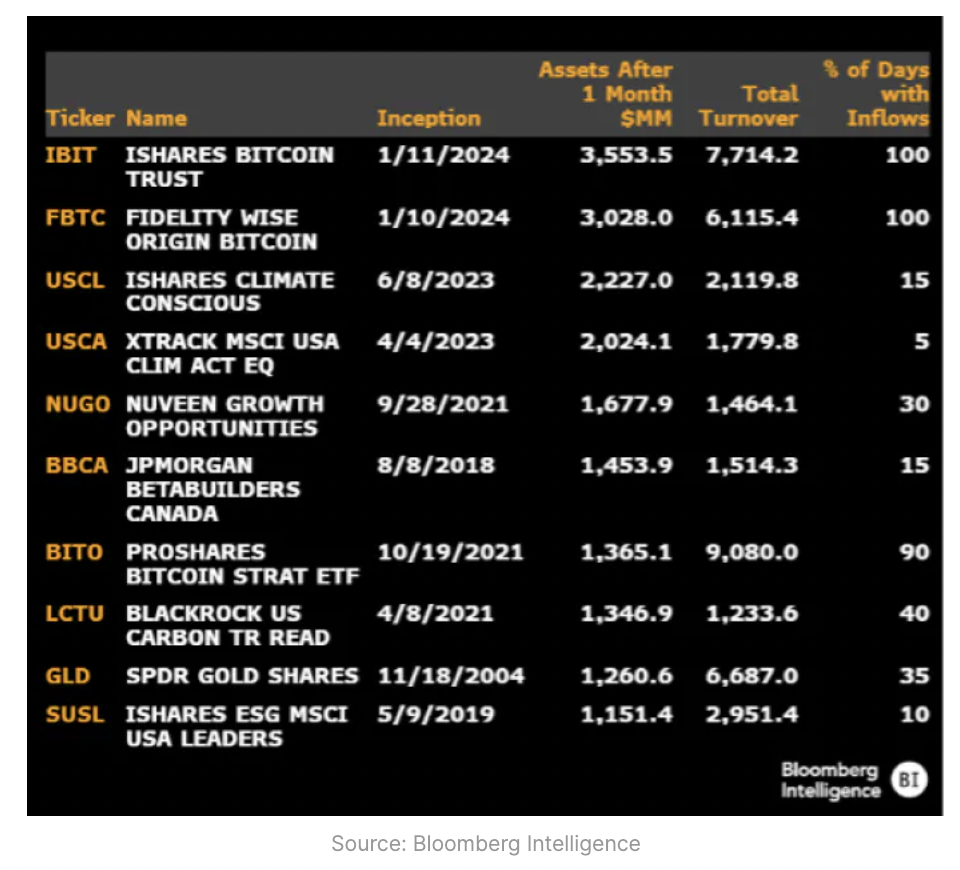

Already, BTC ETFs have seen more than $7.5B in net inflows, and those launched by BlackRock and Fidelity marked the largest debut months of any ETF in the last 30 years.

This incredible momentum is what will finally allow the biggest institutions to join over 52M Americans and another 500M around the world in the onchain economy.

If the tectonic shifts in macro are providing the spark, the flow of institutional capital represents the gas that will light the fire underpinning crypto’s prime-time moment.

Middleware & Infrastructure Upgrades Drive Growth

The exogenous setup is outstanding. Are we ready to seize the moment?

I believe the answer is yes.

Following the crashes of 2022 that sent tourists scattering, crypto natives worked through self-reflection of the excesses and shortcomings that enabled the bubble in the first place.

As capital and talent consolidated around what felt like a full systems upgrade, colossal progress was made across all layers of the stack, setting the stage for a major coming cycle of adoption at scale.

The flow of private funding throughout the year reflected that story. The year started with financial infrastructure commanding the largest share of funding, followed by wallets, and ended with the former dominant once again and L2/interoperability projects in second place.

Amidst all of this, what is particularly fascinating is the infrastructure-application flywheel is starting to catch fire with more concentrated purpose than ever before.

The needs of a growing class of crypto-native consumers are driving directional and focused improvements in the tech stack, which in turn is yielding new use cases and applications.

Superior UI/UX is Fueling Adoption

Q1 2023 saw the release of the ERC-4337 standard, designed to transform externally owned accounts (EOAs) into smart contract wallets to enable customizability, better private key recovery mechanisms, and a materially more streamlined user experience.

Even more impactfully, teams like Privy* made massive progress by simplifying onboarding with embedded wallets to minimize user friction while letting developers design more contextual experiences.

Privy’s efforts helped streamline Friend.Tech’s explosive early capture of 100K addresses in a matter of weeks, and they’ve gone on to power onboarding for OpenSea, Zora, Blackbird and others to the tune of 2M+ users across 150+ countries in the last 13 months.

Meanwhile, Farcaster’s* launch of Frames—a new primitive allowing people to embed interactive experiences directly within Casts—is a transformative move that is already supercharging activity on the platform.

Farcaster has over 8M+ reactions across 4M+ casts and may well represent early signs of a crypto-native consumer app hitting escape velocity.

New Design Spaces Are Getting Bigger and Better

Just as Ethereum sought to go beyond Bitcoin’s functional limitations, a new generation of projects are now targeting Ethereum’s own structural shortcomings in a wave of modularity.

Alternative L1s & side chains have been a feature of previous cycles, but none have succeeded in disrupting Ethereum’s (mainnet) dominance of users, TVL, developers and activity.

This changed with the launch of rollups like Arbitrum and Optimism—projects designed to enable better throughput and lower fees by offloading computation from Ethereum.

While these new layers have reached scale that rivals, or in some cases surpasses, Ethereum itself, builders are dreaming bigger as they seek to further optimize the L1 stack.

That’s because even though the number of daily active users on L2s has risen 8x in the last year, much of what users are actually doing looks largely similar to historical L1 activity. As a result, the emerging consensus is that offloading transactions to cheaper execution environments isn’t enough to enable truly novel onchain experiences.

We need to actually rearchitect the components underpinning blockchains, from Data Availability (DA) to state access bottlenecks and parallel execution.

Standalone data availability (DA) layers built to scale to web2 performance parity (i.e., EigenDA, Celestia, Avail) are coming to market alongside upgraded virtual machines, some based on the EVM and others using alternate engines like Move’s (Movement Labs*) or the Solana VM (Eclipse). Some of these are building L2s to optimize execution only (MegaETH), while others are launching net new L1s from the ground up (Monad).

Meanwhile, EigenLayer’s mission of providing a shared security layer via restaking is making it possible for a new generation of projects to launch in a way that minimizes the need to bootstrap native liquidity and therefore deviate from the core security model of Ethereum itself.

All of this means the underlying infrastructure, tooling, and design optionality on offer to web3 builders is approaching unprecedented levels of maturity and performance.

As crypto’s ethos increasingly resonates alongside upgrades in infrastructure, tooling, and middleware, we’re seeing a promising story in the data underpinning crypto’s paramount leading indicator: developer flows.

Building on blockchains should not just be a more meaningful exercise, but a more technically performant one that effectively empowers developers to design the future of the open internet.

Significantly better retention of existing developers and onboarding of new ones amidst difficult market conditions speaks volumes to the work that’s been done on this front.

Open-Source AI & Crypto Rails

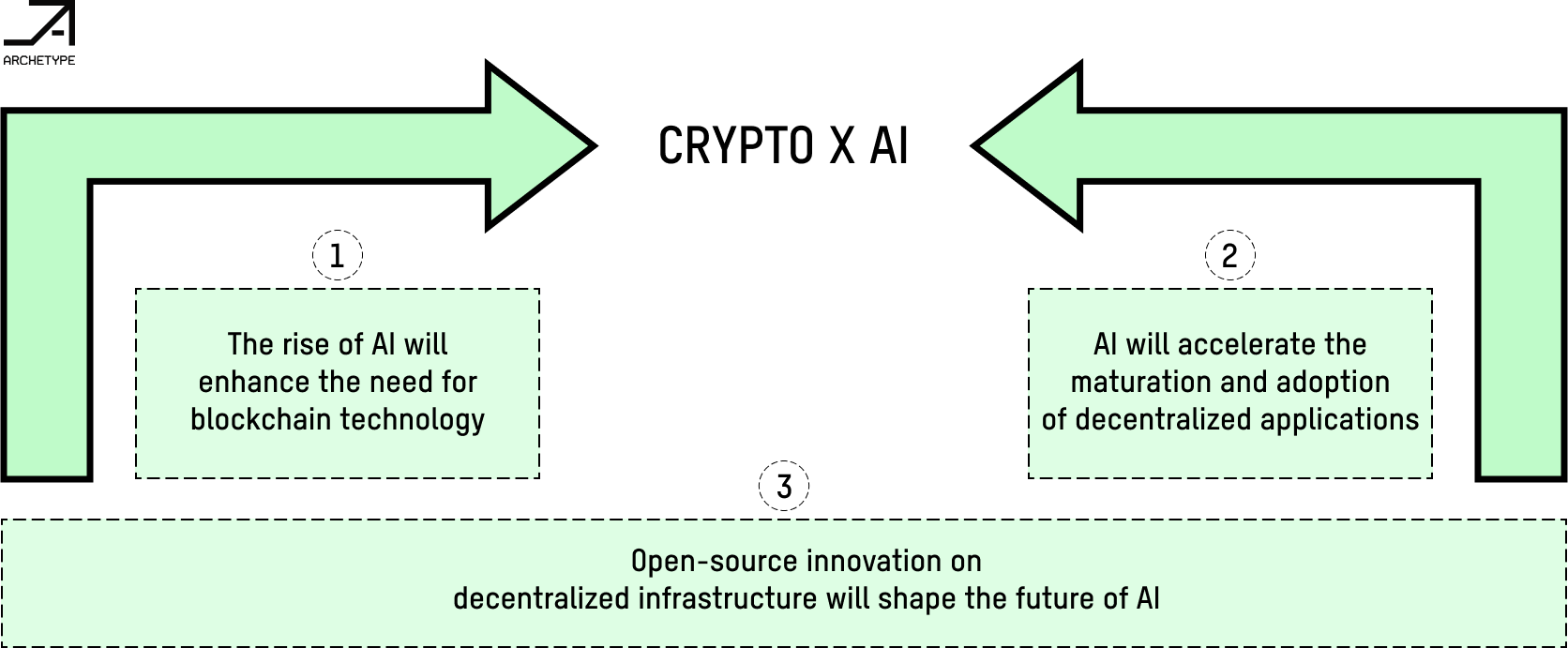

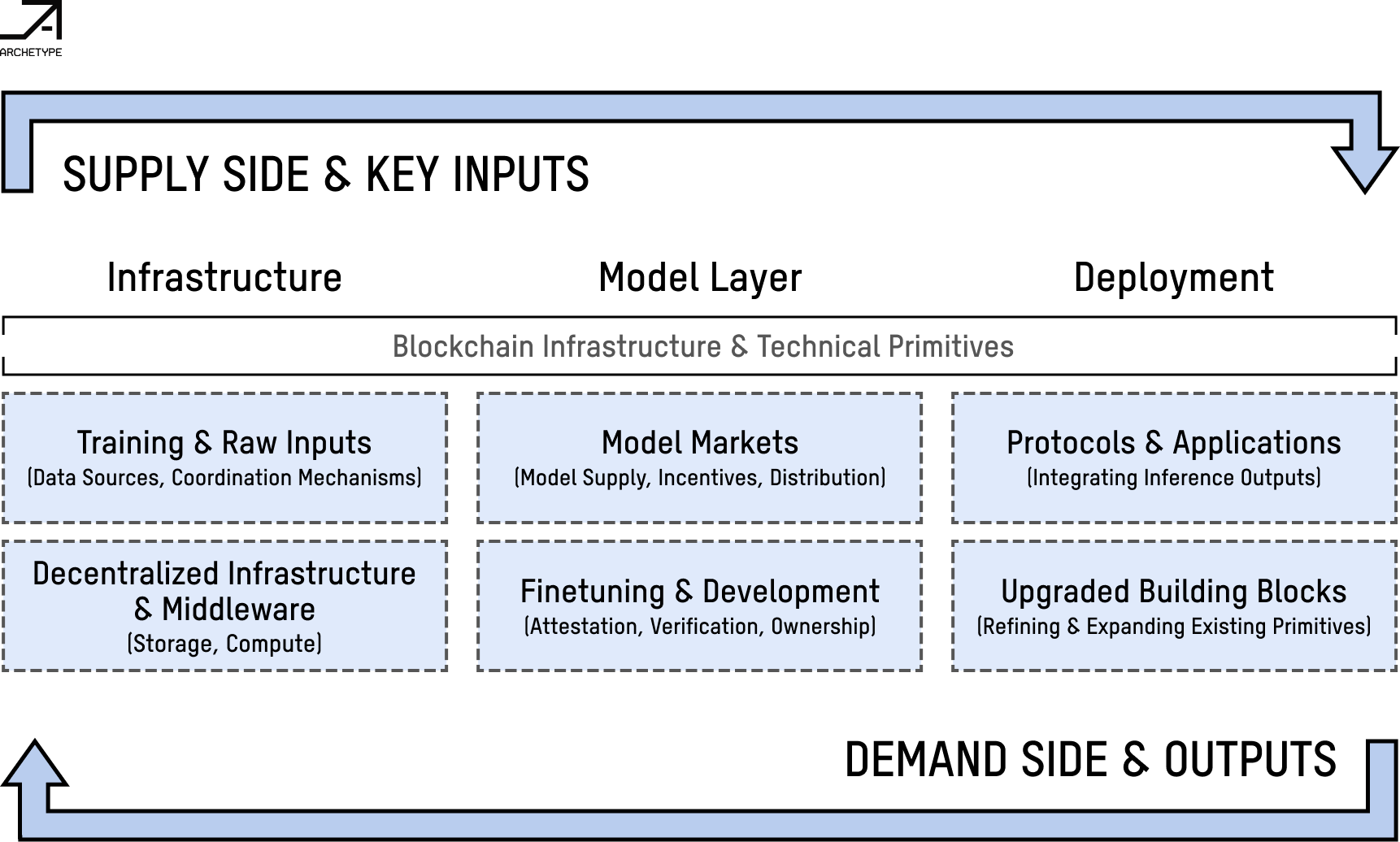

And finally, our belief is that the intersection of crypto and AI—two paradigm shifts in their own right—represents one of the most transformative moments in modern history.

Blockchain rails have successfully undergone a multi-year pressure test in the design of a permissionless system fit for a digital age, and especially an age shaped by generative AI.

Crypto’s toolkit of solutions tackles pertinent problems ranging from resource and liquidity coordination, asset ownership, data provenance, attestations, and much more. Crucially, the maturity of the ecosystem and technology stack are arriving just in time to meet the demands of the AI revolution.

While there is ample room for blockchains to streamline existing machine learning (ML) flows, the most exciting opportunities will emerge where crypto and AI converge to enable completely novel outcomes.

The most exciting new design spaces will span areas like:

Decentralized storage underpinning shared, permissionless repositories for data to enable better training or more performant models via Retrieval-Augmented Generation (RAG)

Zero Knowledge Proofs for model or content verification, training or user data privacy, or enabling edge and local (client side) inference

Novel information markets and better mechanisms for collecting higher quality data as foundation models require more specialized data inputs to continue evolving

Autonomous agents transacting on smart contracts that uniquely enable them to accumulate resources, knowledge and assets using machine-operated private keys

As crypto rails impact everything from the supply of compute to markets for data to the collective creation and monetization of powerful foundation models, open-source AI/ML will be supercharged by crypto, fueling a renaissance in human productivity and open collaboration in the coming years.

Crypto will be the best way to get exposure to the rise of AI, as a proxy via blue chip assets like ETH or directly through ownership or speculation across agents, models, networks, and datasets.

What’s Next?

We’re at an inflection point for this industry. After years of grinding in spite of market, incumbent, and regulatory resistance, the tides are finally shifting.

Crypto’s moment has arrived thanks to the convergence of a few significant tailwinds that are finally ushering in the decentralized future. Amidst this renaissance of infrastructure and middleware, which is already enabling a step function evolution in the onchain experience, there’s an important point we should keep in mind.

In a perfect world, modularity enables not just specialization but also a dissemination of control and points of failure across multiple contributors. However, each of these new puzzle pieces involve different technical and security assumptions, incentive mechanisms, token dissemination roadmaps, VCs, foundation setups, and internal politics.

I don’t want to detract from the inspiring efforts of builders across the space last year, especially in the face of a brutal economic downturn. But as activity and excitement pick back up, it’s imperative we escape the echo chambers and false signals of token grants masquerading as logical integration partnerships, effective PR as community approval, or incentivized behavior as a proxy for organic adoption.

In the coming years, we have a shared responsibility to keep this growing number of projects accountable across technical design choices, token concentration, value dissemination, ideology, and governance.

That’s how crypto wins the endgame.

*denotes an Archetype portfolio company

Thank you to my Archetype colleagues Katie Chiou, Benjamin Funk, Aadharsh Pannirselvam, Ash Egan, Tyler Gehringer, and Dmitriy Berenzon for thoughtful review and feedback.

Announcing Our Investment in Ritual

Archetype is thrilled to lead Ritual’s $25M round and unlock the emerging synergies between AI/ML and crypto.

Earlier this year, ChatGPT became the fastest growing platform ever when it reached 100M active users just a few months after launching. It has since catalyzed a frenzy of adoption and investment around the world.

Our belief is that Ritual is positioned to accelerate a similar phenomenon in web3 by bringing AI onchain and into the hands of crypto’s developers and users.

THE FOUNDATION FOR OPEN AI INFRASTRUCTURE

Ritual is building the foundation for open AI infrastructure in the form of an incentivized network, connecting distributed computing devices. Ritual will be starting with GPUs, serving compute, inference, and model fine-tuning needs, alongside a proof layer with both deterministic and probabilistic proofs to ensure computational integrity.

The incentivized network will permit users to run inference and fine-tuning against a suite of models, ranging from classical to foundation models. These can be built by anyone and will all be hosted on Ritual.

Ritual’s network opens up the supply side for models, compute, and onchain ML services, and entrenches them deep within a critical flow of discourse and shared innovation while also rewarding model creators for bringing innovative and new models across different architectures to the Ritual ecosystem.

Ritual’s overarching mission is to advance collective collaboration and the integration of AI onchain, empowering developers to bring to life more compelling and expressive user experiences all while staying true to crypto’s ethos of being open, permissionless, and gatekeeper free.

AI can enable efficient workflows, transparent governance for existing use cases, as well as a new wave of scenarios where agents, models, and AI-powered smart contracts can operate onchain.

We have high conviction the result will materially advance the overall web3 ecosystem and invite a new – and much larger – audience to find value onchain.

AN INDUSTRY-LEADING TEAM

Ritual is constructing a team to streamline the emerging design space of AI and blockchains, with a deep bench that brings world class experience across both crypto and AI.

Led by Niraj Pant (ex-GP / Head of Investments at Polychain) and Akilesh Potti (ex-Partner at Polychain, ML @ Palantir) alongside a 20-strong team, Ritual is composed of some of the most widely respected professionals in the fields of crypto and AI/ML respectively.

MARKET OPPORTUNITY & LOOKING AHEAD

Ritual’s emerging platform is built for crypto-natives looking for AI models and services comparable to OpenAI and HuggingFace. Its SDK allows for both web2 and web3 developers and teams to enter the fray in a seamless yet powerful way.

Because Ritual is purpose-built to sit at the intersection of web2 and web3 infrastructure and users, its market opportunity is a function of growth across both worlds.

Traditional enterprises are increasingly incorporating web3 into their business strategies, and our belief is that they will look to build or partner with ML-powered systems using inputs from existing markets as well as the nascent domain of blockchains in order to streamline the end user experience.

Ritual is planning to launch its alpha platform in early 2024 with an initial SDK in the coming weeks, and intends to use its fresh funding to develop critical network infrastructure, hire world-class talent, and expand its ecosystem of model creators, compute providers, and end users.

Learn more about Ritual at ritual.global and follow them on X/Twitter at @ritualnet.

Seeding Stackr

Empowering a new class of onchain builders with Stackr’s customizable micro-rollup SDK and verification layer

Archetype is delighted to lead Stackr’s $5.5M Seed Round alongside Lemniscap, Superscrypt, and several other outstanding VCs and angels.

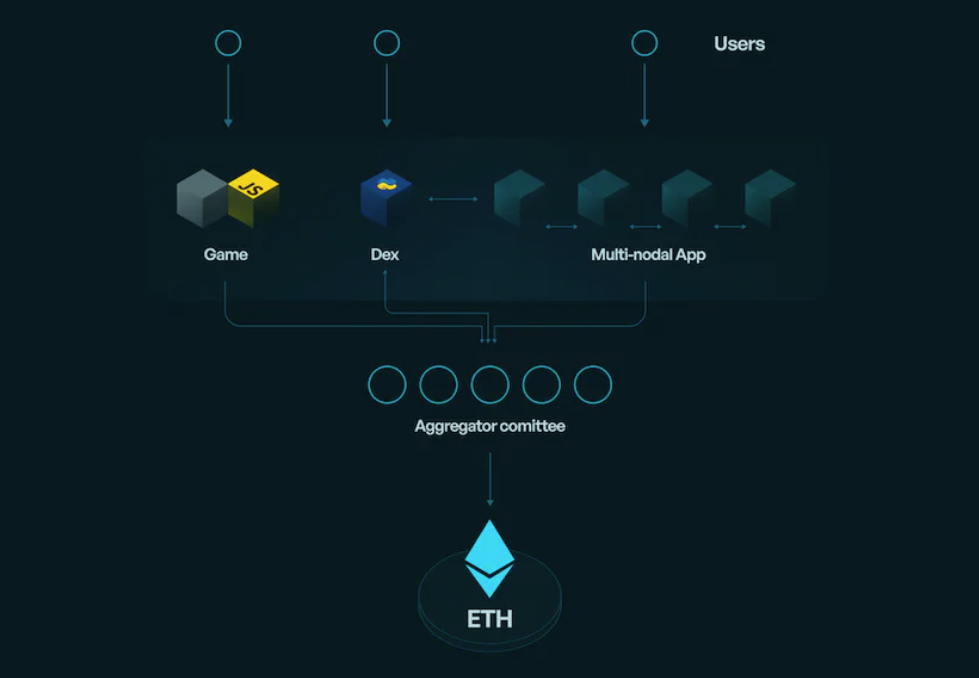

Stackr’s mission is to empower a new class of onchain builders by providing a customizable micro-rollup SDK and verification layer that resemble the conventional developer experience. By prioritizing technical flexibility in the form of micro-rollups, Stackr offers developers a way to build crypto-native applications with familiar tooling while maximizing design choice.

STACKR

Stackr’s value proposition is targeted at two major issues prevalent across blockchains today:

First, web3 development is still very difficult. Building apps onchain is an intimidating experience with a steep learning curve – a major reason why there are less than ~10K full-time developers active today.

Second, builders need more flexibility. Web2 enterprises face unique product, regulatory, and user dynamics. How and why they integrate with blockchain varies significantly, so teams need the design freedom to tailor their onchain strategies accordingly.

Stackr’s micro-rollup framework solves these issues by allowing teams to easily launch new web3 applications, or otherwise migrate existing applications onchain by progressively decentralizing their stack at their own pace.

We’ve written before about the evolution of the interoperability stack and its implications for building scalable, performant applications. Our belief is that micro-rollups represent one of the most exciting developments in this frontier, with the potential to supercharge developer and application efficiency.

ENTER MICRO-ROLLUPS

Conceptually, micro-rollups build on the legacy of microservices in web2. These microservices dramatically simplified and enhanced technical production by breaking down monolithic systems into specialized services, and connecting them to an application’s front end via an API layer.

Micro-rollups go a step further than microservices - and even app-rollups - by transitioning a decentralized application’s architecture to a setup where individual functions can be developed and optimized as independent state machines.

The result is an evolution from app-specificity to logic-specificity which materially improves flexibility, efficiency, and overall performance for onchain applications.

Stackr’s approach to decoupling individual features as micro-rollups that serve smaller, isolated purposes ultimately accelerates production cycles. Each micro-rollup can be upgraded independently or optimized for a specific performance outcome or business need.

Further, Stackr’s SDK allows developers to use the programming language of their choice. This greatly, and immediately, increases the number of developers who are able to build on blockchain today.

Ultimately, Stackr’s micro-rollup framework and SDK expand the strategic and architectural choices offered to application builders. These range from fully onchain dapps to hybrid products for traditional web2 companies looking for finer control over deployment and integration over time.

Source: Stackr's Micro-Rollups Article

STACKR’S STACK

The core products underpinning Stackr’s micro-rollup framework are its SDK and accompanying decentralized verification layer.

The SDK provides developers with the tools needed to build app-specific micro-rollups with maximum flexibility around programming language, proof integration (fraud or validity), ordering (centralized or decentralized), and more.

Meanwhile, the verification layer will consist of a decentralized network of nodes that processes and bundles transactions, generates proofs and performs verification, and submits data/proofs onchain. Stackr also plans to incorporate a proof marketplace that application developers can leverage to better emphasize flexibility and performance.

To further empower developers, Stackr is building a Module Marketplace that will offer a number of modules off the shelf for things like accounting, identity, and more across different development environments and optimized applications.

Source: Stackr's Micro-Rollups Article

STACKR’S ROADMAP

In the coming months, Stackr is focused on releasing an initial version of their SDK built atop Ethereum, which will be compatible with Python and JavaScript.

The team, led by Kautuk Kundan, is making it a point to build in public. They are optimizing for transparency and positioning Stackr to learn from – and grow alongside – the open developer community.

If you’re as excited about Stackr as we are and looking to build with them, you can join their waitlist or apply to join their team!

Blockchains and the Future of AI

Our thesis on the convergence of Crypto x AI and the incredible opportunity set it unleashes

PLATFORM SHIFT, MEET PLATFORM SHIFT…

The world is shaped by periods in which extraordinary upheavals in technology or infrastructure coincide, unleashing a generational step function in innovation. Think telegraphs and railroads, fiber-optic cables and the internet, or mobile phones and 3G.

Our belief is that the intersection of two groundbreaking frontiers – Artificial Intelligence (AI) and blockchains – represents a similarly transformative moment.

Three important pillars underpin this thesis:

BLOCKCHAINS CAN OFFER A SUPERIOR DESIGN SPACE

AI’s high-impact areas are numerous but can broadly be summarized into three main categories:

In particular, Generative AI introduces unique challenges and opportunities that we believe play to the strengths of blockchain technology.

To understand why, it’s important to consider the core inputs that drive the evolution of intelligent systems. Machine Learning (ML) is fundamentally powered by data (quantity but increasingly quality), feedback mechanisms, and compute power.

Dominant players in AI/ML like OpenAI (backed by Microsoft) and Anthropic (with Google and Amazon) are already consolidating resources and building walls around their models and data. But despite early advantages in compute, data, and distribution, this approach risks stifling momentum by fragmenting the collaborative development cycles that birthed the industry in the first place.

Offering a viable counter to this are blockchains like Ethereum, which have emerged as credibly neutral systems of data and compute fueling open-source innovation.

Blockchains already underpin a range of digitally native primitives that are well positioned to serve critical roles in a world increasingly shaped by generative AI.

Our belief is that there is a major opportunity for blockchains to become the primary domain upon which open-source research & development in AI compounds.

THE STATE OF TODAY’S MARKET

A tremendous amount has already been invested in this year’s generative AI frenzy across core infrastructure, the model layer, and even user-facing applications like chatbots, customer support, and coding assistants. Despite that, where (and to whom) value accrues across the traditional stack in the long run isn’t obvious.

In the current paradigm, AI risks being a centralizing force that extends the dominance of web2 market leaders. At the infrastructure and model layers in particular, the name of the game is scale – in hardware and capital resources, access to data, distribution channels, and unique partnerships.

Many of these players – from cloud service providers like AWS to hardware manufacturers like Nvidia to longstanding heavyweights like Microsoft – are going full-stack, whether vertically via M&A or through proprietary partnerships.

The titans at the top are competing for scale and accuracy at the margin, but the market for ultra-expensive, high-accuracy enterprise API models may well be constrained by economics, emerging performance parity of open-source, or even a trend towards lower-latency workload needs.

Meanwhile, a large portion of the middle market is already seeing a commoditization in offerings resembling a collection of ‘OpenAI API wrappers’ with indistinguishable albeit sufficient functionality.

BUILDING ON OPEN-SOURCE MOMENTUM

Open-source datasets for pretraining, training and finetuning, as well as freely accessible foundational models and tools, are already encouraging enterprises of all sizes to get creative with open systems & tooling directly.

A leaked paper from Google outlined just how quickly the gap is closing between the closed and open- source worlds. Notably, 96% of today’s code bases already use open-source software, with the trend particularly evident across Big Data, AI, and machine learning.

Meanwhile, the cloud services oligopoly may be ripe for disruption anyway.

Historically, the big three of AWS, Google Cloud, and Azure have come to own the market by layering on tools and services to entrench themselves deep within the enterprise stack. This dominance has led to a number of challenges for companies, ranging from restrictive operational dependence to excessive costs associated with cloud infrastructure, especially given the premium charged by the major providers.

The pressure on incumbent companies to restructure operating expenses, coupled with a desire to experiment with and integrate the growing range of open-source AI, will create a window to reimagine the stack with decentralized alternatives.

The emerging intersection of open-source AI and blockchain technology therefore presents an extraordinary domain for experimentation and investment.

CRYPTO X AI: A MUTUALLY VALUABLE RELATIONSHIP

We’re profoundly excited by the potential symbiosis between AI and blockchains.

Crypto middleware can drastically improve inputs across the supply side of AI by establishing efficient markets for compute and data (provision, labeling, or finetuning), as well as tools for attestation or privacy.

In turn, decentralized applications and protocols will reach new heights by ingesting the fruits of that labor.

Undeniably, crypto has come a long way, but protocols and applications still suffer from tooling and user interfaces that remain unintuitive for mainstream users. Likewise, smart contracts themselves can be constricting, both in terms of manual workload demands for developers, but also in overall functional fluidity.

Web3 developers are a remarkably productive bunch. A peak of just ~7.5K full-time developers have built a multi-trillion-dollar industry. Coding assistants and DevOps augmented by ML promise to supercharge existing efforts, while no-code tooling is rapidly empowering a new class of builders.

As ML capabilities get integrated into smart contracts and brought onchain, developers will be able to design more seamless and expressive user experiences and, eventually, net-new killer apps. That step function improvement in the onchain experience will attract a new – and likely much larger – audience, catalyzing an important adoption-feedback flywheel.

Generative AI may prove to be crypto’s missing link, transforming UI/UX and catalyzing a major wave of renewed technical development. In turn, blockchain technology will harness, contextualize, and accelerate AI’s potential.

USING BLOCKCHAINS TO BUILD A BETTER MARKET FOR DATA

DATA IS ML’S FOUNDATIONAL INPUT

Yes, huge improvements in compute infrastructure have been instrumental, but enormous repositories of data like Common Crawl and The Pile are what made the foundation models captivating the world today possible.

Moreover, it’ll be data with which companies refine the models underpinning their product offerings or build competitive moats going forward. And ultimately, data will be the bridge between users and personal models that run locally and continuously adapt to individual needs.

The competition for data is therefore an essential frontier, and one where blockchains can carve an edge – especially as quality becomes the prized attribute shaping the market for data.

QUALITY OVER QUANTITY

Early research suggests that up to 90% of online content may be synthetically generated in the coming years. While synthetic training data offers advantages, it also introduces material risks around deteriorating model quality as well as the reinforcement of biases.

There’s a real risk that Machine Learning models may deplete non-synthetic data sources in the next few years. Crypto’s coordination mechanisms and attestation primitives are inherently optimized to support decentralized marketplaces where users can share, own, or monetize their data for training or fine-tuning domain-specific models.

As a result, web3 may prove to be a better and more efficient source of human-generated training and fine-tuning data overall.

COMPOUNDING PROGRESS

Decentralized training, finetuning, and inference processes enabled by blockchains can also better preserve and compound open-source intelligence.

Smaller open-source models refined using efficient fine-tuning processes are already rivaling their larger peers in output accuracy. The tide is therefore starting to shift from quantity to quality in terms of source & fine-tuning data.

The ability to track and verify the lifecycle of both original and derivative data enables reproducibility and transparency that will fuel higher quality models & inputs.

Source: Will Henshall / Epoch (TIME)

Blockchains can build a durable moat as the primary domain with diverse, verifiable, and tailored datasets. This can be particularly valuable as traditional solutions over-index on algorithmic progress to counter data shortfalls.

THE CONTENT TSUNAMI

The coming tidal wave of AI-generated content is another place where crypto’s early-mover advantage will excel.

This new technological paradigm will empower digital content creators at unprecedented scale, and Web3 offers plug and play foundations to make sense of it all. Crypto has homecourt advantage thanks to years of development around primitives that establish ownership and immutable provenance of digital assets AND content in the form of NFTs.

NFTs can capture the entire content creation lifecycle, but can also represent digitally-native identity, virtual assets, or even streams of cashflows.

As a result, NFTs make possible new user experiences like digital asset marketplaces (OpenSea, Blur), while also rethinking business models around written content (Mirror), social media (Farcaster, Lens), gaming (Dapper Labs, Immutable), and even financial infrastructure (Upshot, NFTFi).

The technology may even combat deep fakes and computational manipulation more reliably than the alternative - using algorithms to do the work. In one glaring example, OpenAI’s detection tool was shut down because of accuracy failures.

A final point: advancements in succinct and verifiable compute will also upgrade the dynamism of NFTs as they incorporate ML outputs to drive more intelligent, evolving metadata. Our belief is that AI-powered tooling and interfaces atop blockchain technology will unleash full-stack value and reshape the digital content landscape.

HARNESSING ML’S INFINITE KNOWLEDGE WITH ZERO KNOWLEDGE

The blockchain industry’s search for technical solutions enabling resource-efficient compute while preserving trustless dynamics has led to substantial progress in zero-knowledge (ZK) cryptography.

Though initially designed to tackle resource bottlenecks inherent to systems like the Ethereum Virtual Machine (EVM), ZK proofs offer a range of valuable use cases related to AI.

An obvious one is simply an extension of an existing unlock: efficiently and succinctly verifying compute-intensive processes, like running an ML model offchain, so that the end product, like a model’s inference, can be ingested onchain by smart contracts in the form of a ZK proof.

Storage proofs paired with coprocessing can take this a step further, materially enhancing the capabilities of onchain applications by making them more reflective without introducing new trust assumptions.

The implications allow for net-new functions as well.

ZK cryptography can be used to verify that a specific model or pool of data was in fact used in generating inferences when called via an API. It can also conceal the specific weights or data consumed by a model in client-sensitive industries like healthcare or insurance.

Companies can even collaborate more effectively by exchanging data or IP, benefiting from shared learnings while still keeping their resources proprietary.

And finally, ZKPs have real applicability in the increasingly relevant (and challenging) realm of differentiating between human and synthetically generated data discussed earlier.

Some of these use cases are contingent on the need for further development around technical implementation and the search for sustainable economics at scale, but zkML has the potential to be uniquely impactful on the trajectory of AI.

LONG TAIL ASSETS & LATENT VALUE

Crypto has already demonstrated its role as a superior architect of value flow across legacy markets like music and art. Over the last couple of years, onchain liquid markets representing offchain, tangible assets like wine and sneakers have also emerged.

The natural successor will involve advanced ML capabilities as AI is brought onchain and made accessible to smart contracts.

ML models, in combination with blockchain rails, will rework the underwriting process behind illiquid assets previously inaccessible due to a lack of data or buyer depth.

One method will see ML algorithms query a massive range of variables to assess hidden relationships and minimize the attack surface of manipulative actors. Web3 is already experimenting with creating markets around novel concepts like social media connections and wallet usernames.

Similar to the impact AMMs had on unlocking liquidity for long-tail tokens, ML will revolutionize price discovery by ingesting massive amounts of quantitative and qualitative data to derive nonobvious patterns. These new insights can then form the basis for smart-contract based markets.

AI’s analytical capabilities will plug into decentralized financial infrastructure to uncover dormant value in long tail assets.

DECENTRALIZING THE INFRASTRUCTURE LAYER

Crypto’s advantages around attracting and monetizing higher quality data address one side of the equation. The other side – the supporting infrastructure behind AI – holds similar promise.

Decentralized Physical Infrastructure Networks (DePINs) like Filecoin or Arweave have already built systems for storage that natively incorporate blockchain technology.

Others like Gensyn and Together are tackling the challenge of model training across a distributed network, while Akash has launched an impressive P2P marketplace connecting supply and demand around excess computing resources.

Beyond that, Ritual is building the foundation for open AI infrastructure in the form of an incentivized network and suite of models, connecting distributed computing devices for users to run inference and fine-tuning against.

Crucially, DePINs like Ritual, Filecoin or Akash can also create a much larger and more efficient market. They do this by opening up the supply side to a much broader domain that includes passive providers able to unlock latent economic value, or by consolidating less-performant hardware into pools that rival their sophisticated peers.

Each part of the stack involves different constraints and value preferences, and significant work remains to be done in battle-testing these layers at scale (in particular, the emerging fields of decentralized model training and compute).

However, the foundations exist for blockchain-based solutions for compute, storage, and even model training that can eventually compete with conventional markets.

WHAT IT ALL MEANS

Crypto x AI is quickly becoming one of the most inspiring design spaces. The respective fields are already impacting everything from content creation and cultural expression to enterprise workflows and financial infrastructure.

Together, we believe these technologies will reshape the world in the coming decades. The best teams are natively incorporating permissionless infrastructure and cryptoeconomics alongside AI to upgrade performance, enable net-new behaviors, or achieve competitive cost structures.

Crypto introduces unprecedented scale, depth, and granularity of standardized data into coordination networks, often without an obvious means for deriving utility from that data.

Meanwhile, AI converts pools of information into vectors of relevant context or relationships.

When paired together, these two frontiers can form a uniquely reciprocal relationship that sets the stage for builders of the decentralized future.

*A huge thank you to Niraj Pant, Akilesh Potti, Jason Morton, Dante Camuto, David Wong, Ismael Hishon- Rezaizadeh, Illia Polosukhin, and others for their work at the forefront of this space, invaluable insights, and inspiration – all of which make possible not only this article but crypto’s bright future.

Backing Satsuma

Eliminating the resource-intensive obstacles associated with building with on-chain data so teams can get back to efficient product-innovation cycles

We’re thrilled to co-lead Satsuma’s $5M seed round with our friends at Initialized Capital to help accelerate Satsuma’s goal to make decentralized applications more performant for both developers and end users.

Open blockchains are revolutionizing the way teams build protocols and decentralized applications by providing access to a vast assortment of on-chain data, but the process of querying and indexing blockchain data remains deeply inefficient.

To enable the next billion users to come on-chain, developers need tools that rapidly accelerate the querying and indexing of blockchain data to boost productivity and underpin robust consumer applications.

Where Satsuma sits in the stack:

Satsuma:

Satsuma’s beachhead offering is a drop-in subgraph service that powers a significantly more streamlined and reliable way for developers to explore and utilize on-chain data.

Optimizing for seamless integration is critical. Satsuma makes it easy for teams to switch over to its hosted subgraphs in just a few minutes – unlocking near-instant access to a highly reliable query API and low latency indexing with 99.9% uptime.

Satsuma’s suite of products eliminates the resource-intensive obstacles associated with building on top of on-chain data so that teams can get back to efficient product innovation cycles.

The solutions developed by Satsuma will play a key role in making blockchain data accessible, especially as the application layer evolves beyond its nascency and into the proliferation of mainstream usage and distribution amongst millions of users.

State of Play Today:

Since launching in September 2022, Satsuma has already partnered with outstanding teams like Decentraland, QuickNode, Aragon, and Syndicate, and has cultivated a deep pipeline of additional customers throughout Web3.

Satsuma is led by founders Jonathan Kau and Dan Li, who are leveraging the team’s engineering experience at global technology platforms like Meta, AWS, Heap, and Twitter to develop a proprietary indexing system that can run up to 100x faster than subgraphs.

Investing in DVT and the Future of Ethereum

Investing in Obol with an eye on Ethereum’s future

Archetype is excited to co-lead Obol Labs’ $12.5M Series A alongside Pantera. At Archetype, we’re strong believers in a future where commerce is powered by smart contracts, with Ethereum as the world’s open settlement layer.

Our mission as investors is to find and accelerate projects that reinforce Ethereum’s resilience, ensuring that the network lives up to its promise of a decentralized future.

As early supporters of Obol, we’re committed to supporting them on their journey to bring DVT to Ethereum Mainnet, as well as their broader vision to introduce the technology to other Layer 1 PoS blockchains like Cosmos and Layer 2 scaling solutions (to improve sequencer resiliency).

DVT:

Distributed Validator Technology (DVT) is a new primitive that allows Ethereum Proof of Stake (PoS) Validators to be run across multiple nodes operated by a diverse community or group acting as a single validator.

Distributed Validator nodes operate as a unified cluster by incorporating Charon – Obol’s middleware client – that coordinates individual partial validator signatures in order to create an aggregate signature on behalf of the Distributed Validator.

In a Distributed Validator cluster, each node holds a key share of an aggregate validator key, without the entire key existing in any single location at once. As long as more than two thirds of operators are online, the distributed validator performance is unaffected – even as some nodes in the cluster go offline.

Obol Labs is leading the effort to develop and bring to market DVT – which is critical for decentralization and PoS network security. Obol’s Charon is an additive middleware piece to be incorporated into the broader technology stack by liquid staking protocols and other core ecosystem participants.

As the largest liquid staking provider on Ethereum, Lido has already conducted a successful pilot integration of DVT with Obol on the Goerli testnet, having previously approved a LDO research grant to Obol.

What DVT Unlocks:

DVT minimizes correlation risk by diversifying across geographies and client configurations. With DVT, participating nodes in a cluster can run on machines using different validator, consensus, and execution clients from anywhere in the world.

Diverse node clusters also reduce downtime and potential slashing risk, allowing for significantly improved operator efficacy. Notably, operators seeking to improve uptime no longer need to risk slashing by running active-passive setups in which backup “passive” environments activate in the event the active node fails. In such situations, a variety of errors can lead to both nodes actively attesting with the same validator key and getting slashed as a result.

DVT is also critical for single-node validators who are unable to run active-passive setups and are vulnerable to machine failures which lead to missed rewards, downtime, and ultimately weaker overall network infrastructure for Ethereum.

DVT allows Liquid Staking Providers to democratize staking. Teams like Lido have prioritized the democratization of staking to enable a broader community of members to participate in running validators, as well as protocol decentralization. Obol is therefore working closely with LSPs like Lido, Stakewise, and others to implement DVT.

Obol Today:

Obol’s Athena testnet resulted in a remarkable 5,000+ signups, 200+ successful Distributed Key Generation (DKG) ceremonies, and 100+ Distributed Validator Clusters signing attestations across 40+ countries.

Obol’s active community of 9,000 members is indicative of the excitement and potential surrounding DVT. Where validators are currently seen today as individual actors, a future underpinned by Obol’s DVT will see validators run by distributed communities.

The net result will significantly improve efforts to decentralize Ethereum, reinforce its architectural resiliency, and open the door for people around the world to play a role in validating the network underpinning a global commercial and financial settlement layer.

The Obol team, led by Collin Myers and Oisín Kyne, has long been involved in building core infrastructure throughout crypto, and is responsible for multiple tools including the ETH2 LaunchPad, the ETH2 Calculator, the Internet Bonds thesis, as well as core DVT research at the Ethereum Foundation.

Looking Ahead to Crypto’s 2023

2023 is positioned to be crypto’s most important year yet.

2022 may be remembered as the year of the Black Swans and the fraudulent architects responsible (from Terra/Luna to 3ac, Celsius and FTX’s grand finale) – and rightly so – but it was also a year of remarkable innovation and world class talent inflows.

The tremendous correction in both liquid and private valuations – as well as the wash out of excess leverage and god-like ponzi actors – will ultimately prove beneficial to crypto in the long run.

That said, it was 2020/2021’s macro set up that fueled last year’s events, and it’ll predominantly be macro forces that dictate the speed of crypto’s recovery in 2023 by driving capital and talent inflows.

MACRO & A CHANGING WORLD:

Covid-19 lockdowns, followed by monetary tightening, a collapse in energy supplies as Russia invaded Ukraine, and China’s unwavering commitment to Zero Covid, exposed an uncomfortable reality concerning the prevailing economic order.

Intricate global supply chains built on decades of stable diplomacy have resulted in an extreme overreliance on cross-border human capital, logistics, and raw inputs.

As international relations deteriorated and supply chains fractured (made worse by a post-lockdown shift in consumer spending from services to goods), immense stress has been exerted on the global economy, demonstrating a vulnerability to a changing macro landscape.

While some of these drivers are transitory, others will prove permanent – namely, tighter flows of talent and goods, as well as weaker international collaboration on technological development.

Another major headwind facing many countries: aging populations. In the U.S., the fertility rate sits well below the replacement rate, and at record lows. Given international tensions, skilled immigration isn’t likely to be a solution here anytime soon.

An aging population means a falling labor supply, a decline in productive output, and upward inflationary pressure as governments spend more on care while the elderly become net spenders on healthcare.

2023 will therefore force major countries – in particular, the U.S. – to confront an existential crisis on their ability to power the future of economic and technological progress.

As the domain of permissionless innovation and borderless collaboration, crypto’s relevance in the coming years will be extraordinary – playing the role of digital successor to Silicon Valley and the primary enabler of collective invention.

INFLATION OUTLOOK:

Aggressive fiscal stimulus in response to Covid-19 meaningfully increased disposable incomes, which in turn caused demand to skyrocket in the post-pandemic consumer rebound.

On the supply side, disruptions in manufacturing and transportation networks (driven by prolonged lockdowns in China as well as geopolitical instability in East Europe) pushed up prices of everything from commodities and inputs to shipping and end products.

The combined result saw inflation spike to levels not seen in a generation, and eventually pushed Central Banks (led by the Fed) to raise rates at a near-record pace.

Unsurprisingly, markets plummeted as the cost of inputs and capital skyrocketed, while soaring discount rates reworked the calculus that has underpinned risk assets for a decade.

With China’s reopening this year in particular, prices tied to commodities, manufacturing, and transportation will begin to recede. Meanwhile, the war in Ukraine has seriously accelerated political efforts to adopt alternative and sustainable sources of energy.

That said, inflation is likely to persist above the Fed’s target in the near future as the energy transition takes time and countries and companies reconfigure supply chains to prioritize self-reliance, keeping prices high and permanently denting margins for multinational corporations.

So, while the Fed is likely to soon call an end to its aggressive rate hike strategy, it is unlikely to cut them in 2023, leaving risk assets in an enduringly difficult position.

An important point as we think about a potential recession and prolonged bear market is that thanks to post-2008 regulatory changes, commercial banks remain well capitalized, meaning that while the cost of capital has risen dramatically, the major institutions underpinning global capital markets are well positioned to avoid a credit crunch.

Regardless, crypto is going to have to build its way out of the bear – and it will.

Active developer counts in crypto have staying power in down markets, so the rich talent that came into the space in 2021 and 2022 is largely here to stay, with the opportunity to now go heads down with plenty of cash to deploy.

The bigger question is how traditional high-growth companies find a way forward now that their most reliable levers of profitability – cheap debt, free flowing capital markets, and margin expansion by building in and sourcing from emerging countries – have been seriously curtailed.

Another crucial point: US equity markets benefited from $7.5 trillion in stock buybacks following the 2008 Financial Crisis.

In other words, perhaps the biggest driver of the decade’s explosive equity markets (other than a highly favorable macro environment) has been the companies themselves.

With corporates now facing pressing alternative uses for excess capital – as well as new taxes on stock buybacks – a major tailwind behind rising equity valuations is now firmly in the rearview mirror.

CAPITAL ALLOCATION:

Throughout crypto and traditional markets alike, conventional fundamental metrics have gained renewed importance for investors.

2022’s astounding levels of fundraising means there is plenty of dry powder sitting on the sidelines, but fund managers – especially larger institutions who were publicly burnt by investing heavily in the most speculative of opportunities in recent years – will be far more selective going forward.

We’re likely to see a downstream shift in capital deployment as investors concentrate capital in companies with entrenched product-market fit, meaningful revenues, and strong competitive advantages.

Further, we’ll see a major divergence play out between a small group of obvious winners, in which investors congregate en masse, and the remaining players which are deemed too risky for serious investment.

This is a classic overcorrection in response to a substantial market pullback – and one that will open up rewarding opportunities for bold investors willing to embrace risk and continue funding net-new innovation at the earliest stages.

For late-stage private investors, higher borrowing costs and tighter IPO windows will significantly hinder performance in the coming years. As leverage and multiple expansion respectively become less reliable sources of value creation, firms will need to rely even more on earnings growth. A secondary strategy for mature portfolio companies might involve buy-and-build or bolt-on investments to achieve scale and synergies.

Either way, operational value-add will replace financial engineering and an easy macro environment as the principal driver of returns – a shift which should eventually boost company fundamentals and slowly help normalize private (and ultimately public) markets in Q3 and Q4.

Notably, valuations have yet to meaningfully correct in the private markets. A large part of this is because so many companies raised significant amounts of capital last year and have sufficient runway to avoid repricing their equity by going back to market.

We will likely see the lagging effects of the cyclical downturn play out in the private world in the second half of 2023 as cash reserves get depleted and fundraising activity picks back up.

DIGITAL NOMADS:

The Pandemic was highly effective in accelerating worldwide integration of digitally native behavior across use cases like payments, work, social, and healthcare.

Global 5G usage will triple by 2025, representing over ¼ of all mobile connections. By 2030, more than 80% of the world will have 5G access.

Conversely, estimates suggest that by 2030, there will be a human talent deficit of over 85 million people, representing $8.5 trillion in lost value.

The result is that billions of new users will come online in a world increasingly constrained by geopolitical tensions and unequal access to resources and opportunities.

These opposing forces will drive millions of new internet participants to engage with social, commercial, and work environments underpinned by open blockchains as their gateway to the world.

Crypto rails will liberate and connect talent with resources and opportunities, transcending the obstacles innate to legacy infrastructure.

2023 will be a year defined not by excess and speculation but by organic adoption of blockchain technology by users with real world needs around the world.

This will be particularly evident in rising flows of global technical talent to Web3’s leading teams.

We’ll also see significantly more net-new innovation and startups originating in historically underserved regions like Southeast Asia, North Africa, and South America.

Given Emerging Markets already dominate the Global Crypto Adoption Index, this’ll be a natural transition in which existing users evolve from participants to builders of the future.

THEMES TO WATCH IN 2023:

Ethereum Becomes the Predominant Blue Chip Digital Asset

While headlines centered on crypto’s more distressing moments, Ethereum had another exceptional year, solidifying its role as the predominant innovation platform and settlement layer.

The Merge was a monumental achievement during which Ethereum seamlessly upgraded its consensus mechanism from Proof of Work to Proof of Stake while maintaining 100% uptime for the tens of thousands in transactions and billions in value operating across the network.

Ethereum’s extraordinary economic capacity and underlying architectureis now complemented by its shift to an eco-friendlier profile (a reduction in energy consumption of some ~99%), sustainable economics (100% direct and indirect revenue pass through to long-term holders) and predictable supply (slashing supply issuance by some ~95%).

The net result is that Ethereum now has an asset with corresponding cashflows that can be valued, an energy profile that will satisfy the mandates of major institutions, and an ownership instrument tied to the settlement layer of the future of commerce.

Investors dramatically deepened their understanding of blockchain technology in 2022.

This year will see those same investors shift their focus from BTC to ETH as Web3’s principal productive blue-chip asset.

Distributed Validator Technology

One major evolution introduced by the Merge is in the shift away from a PoW consensus mechanism – in which economies of scale favor centralization of control across a small number of miners – to PoS, which opens the door for a much wider base of potential participants in network validation.

That said, if Ethereum is to realize its potential as the world’s settlement layer and a true global supercomputer, much work remains to be done in effectively decentralizing its network of validators.

Just 4 entities dominate Ethereum staking, with Lido alone controlling roughly ~30% of validators.

Distributed Validator Technology (DVT) is a new primitive that allows Ethereum Proof of Stake (PoS) Validators to be run across multiple nodes operated by a diverse community or group acting as a single validator. Obol Labs is a leading developer of DVT and is building Charon, a middleware client that coordinates individual partial validator signatures in order to create an aggregate signature on behalf of the Distributed Validator.

DVT’s initial deployment will be on Mainnet but will eventually expand to Layer 2s and other ecosystems like Cosmos. SSV is another team building to enable the decentralized future.

DVT can minimize correlation risk by diversifying across geographies and client configurations, reduce downtime and potential slashing risk, but most importantly, it’ll play a significant role in the democratization of staking in the coming years.

Institutional Momentum Picks Up Where It Left Off – Quietly

One important difference between this winter and those of past cycles is that we’ve cleared a point of critical mass in terms of institutional adoption.

As FTX’s collapse ripped through crypto markets, leaders everywhere – from Congress to major institutional investors to technology executives – recognized that it was CeFi that was to blame.

DeFi worked exactly as designed.

Fraudulent centralized entities were using client funds to engage in risky on-chain behavior across DeFi. In one remarkable example, as Celsius’ house of cards collapsed the company was forced to pay back $95 million of its debt with Aave and Compound thanks to the immutable code governing its agreements.

DeFi is leading a revolution that is using smart contracts to reimagine the global financial system, and in a major early test – it performed phenomenally well.

Perhaps institutional adoption of open blockchain technology should be considered inevitable.

In 2022, Stripe unlocked crypto payments for its sellers, with Twitter integrating Stripe’s technology for U.S. based creators to accept crypto payments including USDC. Starbucks reimagined its loyalty program using NFTs, while Reddit launched its Avatar Initiative, with users minting over 5 million NFTs to date – surpassing OpenSea for the total number of users owning NFTs.

Fidelity surveyed 1,052 institutional investors and found that 58% owned digital assets, while 35% believed digital assets to be an independent investment class. Fidelity has also enabled its institutional clients to trade ETH.

BNY Mellon, the world’s largest custodian bank and America’s oldest bank, launched a Digital Asset Custody platform for ETH and BTC, while the Financial Accounting Standards Board revised its treatment of digital assets to make it significantly easier for companies to hold crypto on their balance sheets.

Real World Assets are another exciting frontier. Stablecoins have proven prolific as an early use case. Volumes are up 600% over the last two years, with stablecoins executing an astonishing $7.4T in transactions during 2022 – beating the combined volumes of Mastercard, American Express, and Discover.

RWAs are now expanding beyond the initial use case thanks to teams like Centrifuge, GoldFinch, and Maple Finance, who are paving the way for global institutions to eventually bring trillions in financial transaction value on-chain.

Ondo Finance is bringing US Treasuries and institutional-grade bonds on-chain, allowing stablecoin holders to invest in US Treasuries through a tokenized fund with regulated service providers.

Parcl is another fascinating project committed to bringing liquidity, efficiency, and transparency to the world’s largest asset class with a focus on retail investors.

Their synthetic real estate asset protocol, powered by the Parcl Price Feed, promises to rebalance a global market worth $300T in favor of everyday investors to counter the overwhelming dominance of institutions in the asset class.

The Layer 2 Battle Heats Up

The value of ETH denominated TVL bridged to L2s rose 120% in 2022, with Arbitrum and Optimism in particular attracting talent, capital, and users in large numbers respectively.

Optimism is undergoing a huge enhancement in its scalability infrastructure with Bedrock – an upgrade that will allow for consensus/execution client separation, significantly reduced transaction fees, and sets the stage for the decentralization of sequencers (a major criticism of existing L2 architecture).

Optimism experienced an 847% increase in transaction activity throughout the year, with incentive and education programs including OP Quest playing a major role. Meanwhile, the development of OP Stack – designed to empower builders to create custom Layer 2s – will likely drive further expansion of Optimism’s impressive user base.

Arbitrum also saw its transaction count grow markedly, with an increase of 590% from Q1 to Q4 last year. GMX was the most popular dApp deployed, but the launch of its Nitro upgrade – which introduced increased throughput and better calldata compression – was another boost. Though Optimism initially beat Arbitrum to market, Arbitrum’s open approach has allowed it to rapidly gain market share.

GMX drove an astounding $81 billion in trading volumes last year and kicked off a wave of complementary dApps building around the exchange. The resumption of Arbitrum Odyssey should also help position Arbitrum to continue its strong momentum into 2023.

Meanwhile, Polygon had an incredible year on the business development side, emerging as the partner of choice for many of the largest companies in the world looking to enter Web3. The Polygon team has already made serious inroads on the ZK front by developing a suite of products leveraging the nascent technology, including Hermez, Zero and Miden.

Relatedly, 2022 saw an incredible amount of excitement around Zero Knowledge technology. Emerging consensus suggests rollups built with ZK Proofs will win out over the long term.

The bigger question concerns the ability of teams like Optimism and Arbitrum to pivot their tech stacks should that future play out. Optimism’s development of Bedrock – set to go live sometime in Q1 – would seem to imply the core builders are adjusting their positioning already.

Zero Knowledge Technology

Zero Knowledge Technology benefited from an explosion in interest and capital committed during 2022, and was a headline topic at most conferences, while billions in investments flowed into ZK startups.

2023 is poised to be a major year where the promising technology is finally tested in the wild, with the battle between zkEVM and non-EVM compatible L2s set to dominate. A few teams are working to bring the Ethereum experience to a ZK-enabled environment, while a different group are working on completely separate Virtual Machines to enable a range of new possibilities.

StarkWare (building StarkEx and StarkNet) has emerged as one of the early dominant players amongst the latter, with StarkEx (their initial product) having facilitated $797 billion in cumulating trading volume across 313 million total transactions. The team’s decision to build using the programming language Cairo, rather than around the Ethereum Virtual Machine, means their technology breaks free from a number of limitations tied to EVM architecture and is directly compatible with Account Abstraction.

Matter Labs’ zkSync aims to build the first EVM compatible ZK rollup with native integration of Account Abstraction, though it remains unclear how close the team is to achieving true EVM-compatibility, and whether it can deliver a better user and developer experience by pursuing EVM compatibility.

Meanwhile, Polygon is designing multiple ZK-based solutions – Hermez, Miden, and Zero – and is allocating an audacious $1 billion of its treasury to the space. Polygon is another player building towards zkEVM compatibility.

Others, including Scroll, Aleo, Aztec, Espresso, and even ConsenSys are building their own solutions with different end goals and design choices around security, privacy, and scalability.

Ultimately, the ZK field is crowded but well-funded. 2023 will be the year where the few winners put distance between themselves and the rest of the pack, with differentiators centering on architectural design choices (ie: EVM vs non EVM), as well as business development initiatives (Polygon has done exceptionally well thus far).

The latter may well play a more decisive role this year as dApps and users pay less attention to incremental technological advantages between competing solutions.

App Specific Rollups Expand and Optimize Ethereum’s Horizons

App Specific Rollups are another field that will pick up strong momentum in 2023. As scalability infrastructure matures, many protocols and dApps will find that general purpose rollups are redundant and inefficient in their use of data given their need to mirror the underlying chain and optimize for a wide variety of applications and use cases.

Rollups specifically designed for a single application or purpose are able to leverage the base settlement layer’s security and liquidity while still optimizing for an explicit use case. The outcome is an environment that is secure, efficient, and benefits from the broader ecosystem within which it exists – without relying on risky cross-chain bridging for liquidity transfer.

There are arguments in favor of standalone App Chains – namely, the ability to optimize the entire stack by using different layers (ie: settlement vs execution vs data availability) designed for specific functions.

That said, benefits to building atop a unified settlement layer include the aforementioned security advantages and avoidance of liquidity fragmentation (without taking on unnecessary risk), so App Specific Rollups remain a highly exciting solution in the near term.

Visionary early projects include Stackr and AltLayer, among others. Further development around trustless bridging, including the incorporation of ZK technology, will almost certainly play a determinative role but we’re still some distance from this reality.

NFT Technology / Use Case Expansion

NFTs had a blowout year in 2021, with momentum continuing well into 2022 despite the market downturn. The number of unique NFT traders reached 10.6 million in 2022, increasing 877%, while total sales grew 10% to reach 68 million.

OpenSea remained the dominant marketplace in 2022, but upstarts including X2Y2 and Magic Eden had big years (even when accounting for a ton of wash trading), while SudoSwap was able to capitalize on the bear market’s rejection of NFT royalties.

2023 will see further erosion of OpenSea’s dominance as creators and specialized platforms continue to innovate around concepts like royalties, utility, and other concentrated applications of NFT technology, while teams like Reservoir are enabling a future of curated market experiences by aggregating and making liquidity & orderbooks accessible.

NFTFi will drive new innovation around NFTs as a financial and productive asset. Emerging frontiers including Lending/Borrowing, Renting, Fractionalization, and Derivatives will gain additional traction as blockchain rails transform digital art from the speculative to the productive.

Last year, total loan volume using NFTs as collateral reached $500M in one indicator of the momentum behind this emerging paradigm.

Account Abstraction

Wallets in Web3 have historically taken the form of Externally Owned Accounts like MetaMask, with an address identifier and a pair of private and public keys. This solution offers guaranteed ownership and deep cryptographic protection to users, but also means that if a user loses its key (without a backup seed phrase), they lose access to their account, as well the assets contained within it.

The other issue is that there is a restrictive link between the account controlling the assets and the signer with the power to move the assets.

Account Abstraction is a new solution that breaks that link, enabling transaction authorization to become programable by transforming accounts into smart contracts.

A core unlock here centers on social recovery: in the event a user loses their private key, Account Abstraction can build in additional functionality around replacing the key with authorization, including multi factor authentication. AA also enables multiple signers to hold transaction authorization power to better reinforce security and protect against fraud, while multiple transactions can also be bundled to enable single approval.

In one interesting application, Visa is exploring AA for use in enabling auto payments.

EOAs were an incredible early innovation, but to unlock mainstream entry into Web3, AA is a potentially critical advancement that provides better user comfort and improves the overall experience around ownership and self-custody of digital assets.

EigenLayer & Re-Staking

A hurdle in the development of new decentralized infrastructure and applications is the need to scale capital rapidly in order to secure the underlying architecture in a way that prevents a single actor from attacking or manipulating it.

Beyond initial VC investments and mercenary capital attracted through token incentive programs, many projects struggle to attract and develop a high-quality underlying network of cryptoeconomic trust.

A proposed solution comes from EigenLayer in the form of re-staking – a new primitive that unlocks the rehypothecation of staked ETH from Ethereum’s consensus layer to be used by new infrastructure seeking to build a robust security layer. Stakers can choose to re-stake their ETH in a way that extends cryptoeconomic security from the base layer to other protocols in the ecosystem.

As previously fragmented pockets of capital consolidate, the overall network becomes more resilient, while stakers get exposure to additional yield (albeit at the expense of opening themselves up to greater potential slashing risk).

EigenLayer’s solution therefore promises to bootstrap development of new infrastructure and applications throughout the network, while freeing up staked ETH to become even more productive.

Web3 Social & Decentralized Identity Gets Even Bigger

Decentralized Identity kicks off 2023 with a ton of momentum. ENS – which enables users to create and own Ethereum-based domain names – had a defining year.

Over 2.8 million ENS names have been created by more than 630,000 unique users. ENS also announced a partnership with Coinbase, making ENS usernames available to Coinbase IOS and android users.

ENS operates much like a DNS does, translating and linking wallet addresses to human-readable identifiers, and will be a critical piece of infrastructure as more of the world moves on-chain.

POAP is another core primitive that has connected on-chain identities to off-chain activities, allowing communities and their members to build identity and shared experiences using NFT technology. To date, 4.5 million POAPs have been issued by 800,000 unique wallets around shared interactive experiences.

Its partnerships with companies like American Express and Adidas are also indicative of its real-world potential.

Farcaster is building the social network of the future using a permissionless protocol open to developers who can freely build applications using Farcaster’s open data layer. Over 30 such apps have been built on top of Farcaster already, offering fascinating insight into social network effects in a decentralized world.

Farcaster’s approach is already expanding the design space around on-chain social networks in a number of fascinating ways.

Lens is another decentralized social media protocol in which users create a profile by minting an NFT. In order to engage the network (follow someone, create content, etc) Lens users mint additional NFTs on-chain, thereby creating an ever-expanding social graph in which users have full ownership of their social identity. Follower NFTs are programmable and can also be encoded with additional value.

This core unlock removes the power and censorship traditional Web2 media companies retain over their users and represents a major step towards true permissionless social discovery.

Web3 Social and Decentralized Identity primitives are positioned to have an explosive 2023 and will be one of the most exciting arenas for innovation within Web3.

In Summary:

2023 will be an incredible year of collective innovation, free from the noise and speculation that muddied recent years.

Gaming: Crypto’s Native Frontier

Exploring one of Crypto’s biggest frontiers for innovation and adoption: Gaming

For billions of people around the globe, Web3 represents an opportunity to realize a vibrant new digital world — one that isn’t designed and controlled by a handful of executives in the glass towers of primarily Western megacities.

It isn’t just about economic empowerment, either.

Web3 offers transformative potential that stretches deep into the realms of cultural identity, entertainment, and communication… and ultimately into the place where these concepts have converged for thousands of years: gaming.

The Crypto Revolution is going to reshape our world not because engineers in Silicon Valley are creating a new generation of user technology, but because Web3’s diverse participants are creating open infrastructure that people everywhere will use to build new worlds themselves.

Today, gaming is a $200B market composed of 3 billion gamers and the fastest evolving form of media in the world.

In order to understand why gaming will be a core frontier in the context of the social-technological revolution playing out today, we first need to explore gaming’s history and trajectory.

The Very Beginning:

Gaming is as native to human culture as language is (and in fact may even predate it).

Serving as an invaluable social mechanism throughout history, we’ve used games to bond, teach, develop our values, and make sense of the world.

The cradle of civilization that was the Middle East naturally saw the emergence of the first examples. In the 3000s BC, Mesopotamians played The Royal Game of Ur on beautifully painted boards, while the Egyptians played Senet.

Chaturanga would formally appear in India around 600 AD, though examples of its predecessors date back to 3000 BC. The Persians adopted it as Shatranj before European traders brought it over and turned it into Chess.

As far back as 2000 BC, Mesoamericans were playing a ballgame on courts. The activity was of immense societal importance, incorporated in rituals and used to resolve conflicts or even war.

This era also saw Ancient China develop Wei Qi — known today as Go — originally used to practice and refine strategic thinking. Later Chinese dynasties would also invent playing cards and dominoes.

Games have always held enormous societal significance across a variety of contexts — military, social, educational, and entertainment

We now think of it as an industry, but throughout the majority of our history gaming was an intrinsic activity that underpinned most of culture

We congratulate ourselves for our use of games to teach, train, and connect, when in reality humans have very effectively used games to do all of this for thousands of years

Today’s progressive gamification of society — investing, learning, working, collaborating — is really just a revival of an ancient behavior codified in our brains

Back to the Future: